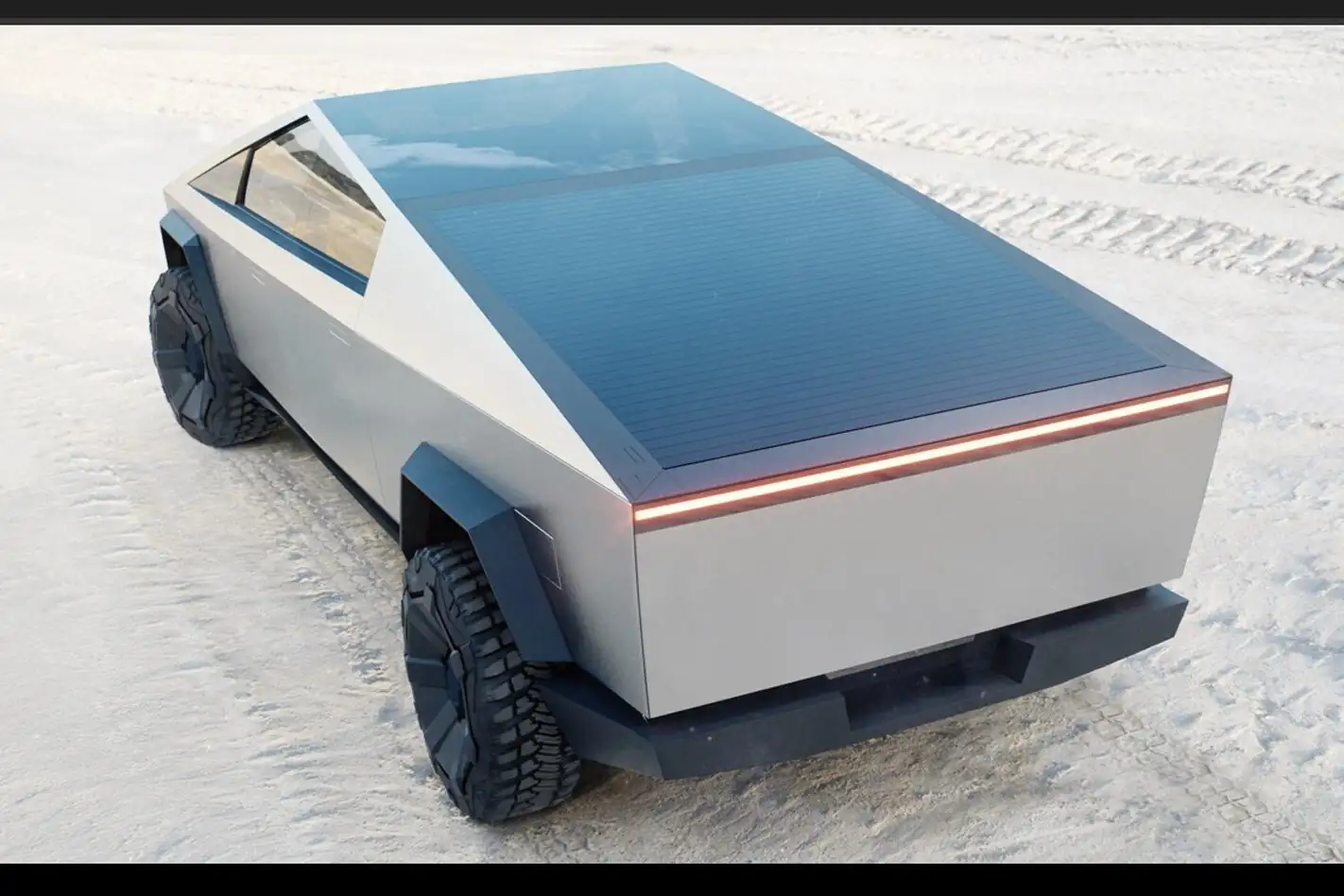

Let’s cut to the chase: you’ve heard the buzz. People are saying insurance companies don’t want anything to do with the Tesla Cybertruck. Is it true? And if it is, what can you do about it?

If you’re eyeing a Cybertruck or already own one, this is probably top of mind. You’re not alone—owners across the board are scratching their heads, wondering why their dream truck is causing hiccups with insurance. Let’s break it all down, in plain English.

Why Are Some Cybertruck Owners Struggling with Insurance?

Here’s the deal. Insurance companies look at a bunch of factors before they agree to cover a car. With the Tesla Cybertruck, some of those factors are raising red flags.

High repair costs, a unique design, and expensive parts? Yep, they all play a role. But it’s not all doom and gloom. Many Cybertruck owners are still getting insured without a hitch.

Let’s dig into the main reasons why some folks are hitting roadblocks.

1. The High Cost of Repairs

The Cybertruck isn’t your average pickup—it’s built like a tank with ultra-tough materials, and that toughness comes at a price.

- Example: One owner reported a $13,000 repair bill for a small dent and a cracked bumper. That’s no small change!

- Insurers see numbers like that and think, “If a tiny repair costs this much, what happens in a major crash?”

Insurance companies don’t love unknowns, and with repair costs this high, they’re cautious.

2. Parts and Repairs: Not as Simple as It Sounds

Tesla vehicles, including the Cybertruck, often face delays when it comes to repairs. Why?

- Replacement parts can take a long time to arrive.

- Specialized repairs might need Tesla-certified technicians, and there aren’t enough to go around.

If a car is out of commission for months, insurance companies might end up footing the bill for a loaner vehicle or additional costs. Not ideal from their perspective.

3. The Value of the Cybertruck

Here’s the kicker: the Cybertruck’s value might be too high for some insurers’ underwriting guidelines.

- Some companies have caps on how expensive a vehicle they’ll cover.

- If the Cybertruck exceeds that cap, insurers might say, “No thanks.”

But don’t worry—it’s not all bad news. Let’s talk solutions.

Do Insurance Companies Really Refuse to Cover the Cybertruck?

It’s not a blanket “no.” Major insurance companies like GEICO and State Farm have said they’ll insure Cybertrucks. That said, there are some caveats.

- GEICO: While they’ve stated they insure Cybertrucks, some owners have reported dropped policies. The company hasn’t clarified why this happens in individual cases.

- State Farm: They’ve confirmed they’ll insure Cybertrucks, but they also stress that each case is unique. Factors like your driving history and location play a role.

So yes, it’s possible to get insured. But it might require a little extra work.

What Can You Do if You’re Struggling to Insure Your Cybertruck?

If you’re running into trouble, don’t panic. There are practical steps you can take to make things easier.

1. Shop Around for Coverage